Products and resources of Africa

African Economic Outlook 2013. Certainly, Africa’s pace of growth has been impressive, averaging 5.1% of GDP per year – much faster than most OECD countries. Some have dismissed this simply as reflecting only the recent boom in natural resource prices. They point to the fact that prices of most commodities – agricultural, mineral and energy – doubled or even tripled over the same period, and warn that Africa’s growth will come to an end once resource prices taper off, as it is happening now.

This viewpoint misses the real story on two counts. First, natural resources and their improved terms of trade contributed only a third of Africa’s growth. That’s quite a lot, but not enough to make Africa’s growth exclusively a resources story. Instead, much of Africa’s success is actually a productivity story. Applying new methods of measurement, the African Economic Outlook 2013 finds that Africa’s labour productivity increased by close to 3% during the 2000s, with almost half this attributable to workers moving to new activities with higher productivity. By contrast, Latin America’s productivity growth was less than 1%.

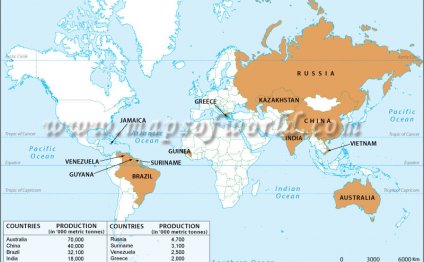

Second, rather than being the exclusive drivers of growth, Africa’s natural resources are contributing less than they could do. Agricultural commodities are a striking example: 24% of the world’s agricultural land is in Africa, but only 9% of agricultural production. With regards to mining, spending on exploration in Africa has remained below $5 per square kilometre; in Canada, Australia and Latin America the average is $65 per square kilometre.

So the story of Africa’s growth and natural resources is a mixed bag: On the upside, Africa’s growth rests on a much more diversified base than is often assumed. On the downside, Africa failed to make the most of its natural resource wealth during the recent boom. Had it done better, overall growth and the type of structural transformation that can provide more and better jobs would have been higher.

“Hang on, ” you might say now. “Isn’t it conventional wisdom that for development to take off a country must leave commodities behind and focus on building factories? Shouldn’t it then be a good thing to leave most resources in the ground?” Not quite. If managed well, natural resources can play a crucial role in transforming economies. This can happen through three channels: diversification, capabilities and revenues.

Diversification, which essentially means the range and variety of products a country exports, is an important driver of growth in developing countries. Given the right conditions, natural resources can be an important source of diversification. Chile, for example, used proceeds from copper to invest in new agricultural commodities, such as salmon, that it previously did not export. Malaysia invested its oil revenues in forestry and palm oil, building very successful industries. Indonesia used oil revenues to supply fertilizer to farmers and develop new crops, building the basis for the country’s green revolution.

Capabilities are the cornerstone of structural transformation. In simple terms, these represent the things a country “can do” – its technological know-how and skills, for example, or the quality of its public services in areas like infrastructure, education and health, and much, much more. Countries with strong and diversified natural resource production have more opportunities to develop their capabilities. Take South Africa, which went from supplying simple tools to its miners to become an internationally competitive supplier to the world’s mining industry. Chile successfully developed local know-how on adapting mining technology to local conditions, while Nigeria has started to build up a supplier industry for its resource sectors.

Capabilities make the link between the production of basic commodities and diversification at large. On average, the more unprocessed commodities a country exports competitively, the more manufactured products it exports competitively. For example, South Africa exported 46 raw commodities competitively in 2005 and 197 manufactured final products in 2010. Angola only exported one commodity (oil) competitively in 2005 and 24 manufactured final products in 2010.

Finally, the third channel – revenues – offers arguably the greatest benefit from extractive industries in the short to medium term. Invested wisely, the proceeds from mining and petroleum production can be used to fund many of the crucial inputs for structural transformation such as education and health, as well as infrastructure and strong public services.

So, instead of putting natural resources aside, African countries should look to them for their strengths and the opportunities they offer to create a diversified economy.

RELATED VIDEO

Share this Post

Related posts

Agriculture of Africa

One of the myths outlined in the report The Poor Are Getting Richer and Other Dangerous Delusions that Global Justice Now…

Read MoreGDP of Africa

THE impending exit of UK bank Barclays from Africa is raising lots of dust, as theories fly over why a transnational that…

Read More