Nigerian Export-Import Bank

Ms Dorothy Enuka OGBUTOR is currently the Head, (Specialised Business Department) of Nigerian Export-Import Bank [NEXIM]. She is a graduate of the University of Jos with a Bachelor’s Degree in Sociology in 1988, and an MBA from the University of Calabar in 2004. Ms Ogbutor worked briefly in two Finance Houses as Treasury Officer, from where she began her banking career with the Nigerian Export-Import Bank [NEXIM] on February 1, 1993 as Export Credit Officer II, and has since been in the services of the Bank till date.

Ms Dorothy Enuka OGBUTOR is currently the Head, (Specialised Business Department) of Nigerian Export-Import Bank [NEXIM]. She is a graduate of the University of Jos with a Bachelor’s Degree in Sociology in 1988, and an MBA from the University of Calabar in 2004. Ms Ogbutor worked briefly in two Finance Houses as Treasury Officer, from where she began her banking career with the Nigerian Export-Import Bank [NEXIM] on February 1, 1993 as Export Credit Officer II, and has since been in the services of the Bank till date.

Ms Ogbutor in the number of years in the Bank had acquired broad experiences in various aspects of the Bank’s operations [Corporate Services and Business Development Groups]. The positions held prior to the present schedule are Head Calabar Area Office, Head Lagos Area Office, Head Trade Finance Appraisal Department and Head Treasury/Foreign Operations.

Ms Ogbutor represents the Bank at various meetings, fora, and professional bodies. Some of the representations include Executive Council Meeting of the West African Bankers Association [WABA]; United Nations, International Trade Facilitation Forum; Association of Nigerian Development Finance Institutions [ANDFI], and was the pioneer Editor-in-Chief of the Journal of the Association titled “Development Finance Platform” as well as Association of African Development Finance Institutions [AADFI] to mention but a few.

She also represents the Bank at various strategic partnership meetings with Manufacturers Association of Nigeria, Export Group; NACCIMA Export Action Group, etc. Currently, she is the Alternate Director, representing NEXIM on the Board of NEXPORTRADE Houses Limited, a Public/Private Partnership [Export Trade House/Export Facilitation] company, in the Nigerian company and a Director in NEXPORTRADE Houses Liberia Inc.

As the Head, Specialised Business Department, some of her core functions include managing Strategic Alliances with Export Credit Agencies [ECA’s], EXIM Banks, as well as multilateral institutions and other international financial institutions. In addition, sourcing & managing of operational funds through Concessionary Loans, Lines of Credit as well as facilitate funding under loan syndication and co-financing arrangements, and undertaking financial advisory services.

RELATED VIDEO

Share this Post

Related posts

Agriculture Vacancies in South Africa

Agriculture involves growing, harvesting and creating of food products. Physical fitness is essential because of the manual…

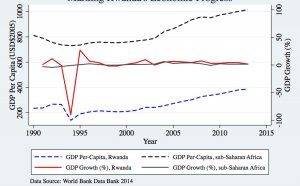

Read MoreGDP per capita sub Saharan Africa

Growth still robust but at lower end of range by recent standards Sharp decline in oil prices poses formidable challenges…

Read More