Imports and exports of Africa

Also available in: Arabic | French | Spanish Rows of solar panel at a thermo-solar power plant in Morocco. (Photo: Dana Smillie / World Bank)

Also available in: Arabic | French | Spanish Rows of solar panel at a thermo-solar power plant in Morocco. (Photo: Dana Smillie / World Bank)

Over the past several years much has been written about the significant potential for solar energy generation in the Middle East and North Africa, where there is no shortage of sunshine. The International Energy Agency estimated that the potential from concentrated solar power technology alone could amount to 100 times the electricity demand of North Africa, the Middle East and Europe combined.

In the wake of commitments at the Paris climate conference (COP21), it is time to develop this rich source of low-carbon energy sitting close to Europe’s southern shores, and bolster efforts to agree on a framework to import clean, sustainable energy from North Africa.

As recently as 2012 there have been efforts to adopt a framework that would allow importing renewable energy from Morocco to Germany—through France and Spain—but electricity trade between countries typically becomes reality when there are economic benefits for all sides. Electricity trade has the added benefit of fostering closer political ties.

Expanding regional trade between North Africa and Europe has also been hindered by inadequate physical electrical connections between the two continents and poor physical integration in European electricity grids. There is currently only one electrical transmission interconnection between North Africa and Europe, namely the Morocco-Spain connection. Further, Spain’s interconnection with the rest of Europe is limited, with no new transmission projects undertaken to expand this capacity for the past three decades. At the same time, Spain had excess generation capacity because of the economic downturn experienced in Europe over the past several years. That made impractical the notion of allowing North African renewable energy into the Spanish market. Italy, another potential electricity gateway from North Africa, was in a similar situation.

Recognizing that energy market integration is essential to achieving its ambitious renewable energy (RE) targets, the European Union (EU) has now made reinforcement of electricity transmission interconnections a priority. The EU has set an interconnection capacity target of at least 10 percent of the power generation capacity for each member country. In this respect, boosting links to isolated power markets, such as Spain, Italy and the UK, became a key pillar of European Commission President Jean-Claude Juncker’s stimulus plan announced in 2014.

With strong support from the EU, Spain and France agreed to construct a new transmission line through the Pyrenees Mountains. The 64.5 km, €700 million project was completed in 2015, doubling the transfer capacity between the two countries to 2, 800 MW. However, this new project brings Spain’s transfer capabilities to only 6 percent of its generation capacity, still short of the EU’s 10 percent target.

In March 2015, France, Spain and the EU issued the Madrid Declaration in which they committed to increasing transfer capacity between France and Spain to 8, 000 MW. A planned, second submarine cable through the Bay of Biscay (west of the Pyrenees) will bring the France-Spain interconnection capacity to 5, 000 MW, but this line is not expected to come online until after 2020. Two other projects (through the Basque Country and between Marsíllon and Aargón) intended to add another 3, 000 MW of transfer capacity are planned, but it is unclear when they will be commissioned. The EU promised significant funding for all three projects.

With the EU’s adoption of stringent 2030 climate change targets, there is an opportunity to re-visit the rationale of continuing to subsidize RE projects in Europe when clean energy may be obtained more cheaply from its RE-resource rich neighbors. The new targets are expected to increase the low-carbon energy sources in the EU to 37 percent by 2030, which also highlights the urgency of investments in transmission infrastructure and transfer capabilities among EU member countries to increase power system flexibility to accommodate the higher RE share.

The cost of importing clean power from certain North African countries to Europe is minimal in comparison to the savings achieved from better solar and wind conditions on the southern Mediterranean shores. Morocco, in particular, already has an existing 1, 400 MW link with Spain and a successful solar and wind energy programs that will see the addition of at least 4, 000 MW of wind and solar capacity in the next 5 years. In this respect, importing clean power from Morocco is feasible without significant investments in transmission infrastructure.

Renewable energy imports also increase Europe’s energy security by diversifying its sources of supplies and switching from over-reliance on gas imports.

The EU imports 66 percent of its domestic gas consumption, with imports from Russia and Norway alone representing 50 percent of its gas supplies. Algeria, which has had a long and fruitful energy trading relationship with Europe, is the second-largest gas supplier to the EU outside the region, after Russia. Much of these gas imports are used for power generation. Increasing Europe’s flexibility to import renewable energy gives it more options to explore pricing differential (or “spark spread”) between importing gas and electricity.

Lastly, more integration with North Africa creates more opportunities to increase employment and economic stability in a region that has recently been marred by significant political upheaval.

There is a win-win opportunity for both Europe and North Africa to increase their energy integration and establish a mechanism for renewable energy trading. Agreeing on such a mechanism by the time global leaders meet again for COP22 in Marrakesh in 2016 would make a bold statement about Europe’s substantive commitment to cross-Mediterranean integration and continued economic development of the Middle East and North Africa (MENA) region.

RELATED VIDEO

Share this Post

Related posts

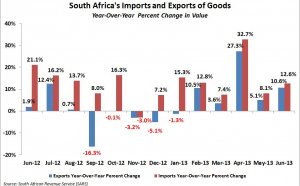

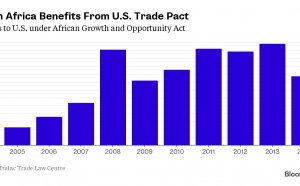

SA imports and exports

South Africa s liberal trade incentives are aimed at encouraging economic growth and development. It is a member of the World…

Read MoreSouth African exports and imports

The Trade, Development and Co-operation Agreement has established a free trade area that covers 90% of bilateral trade between…

Read More