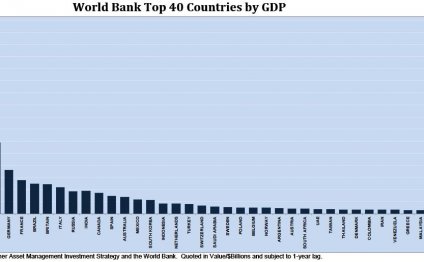

Largest GDP 2013

Economic growth was solid in the fourth quarter, a testament to the resilience of American businesses and families. The private sector’s strong performance in the fourth quarter caps off its fastest year of growth since 2003. And over the four quarters of 2013, real GDP grew 2.7 percent, its strongest rate in three years. Nevertheless, the unemployment rate is still unacceptably high, and too many Americans are still looking for a job and fighting to make ends meet. In his State of the Union address on Tuesday night, President Obama outlined his plans to build on the progress made to date and ensure 2014 is a year of action, with steps to increase growth, create new jobs, and expand economic opportunity.

Economic growth was solid in the fourth quarter, a testament to the resilience of American businesses and families. The private sector’s strong performance in the fourth quarter caps off its fastest year of growth since 2003. And over the four quarters of 2013, real GDP grew 2.7 percent, its strongest rate in three years. Nevertheless, the unemployment rate is still unacceptably high, and too many Americans are still looking for a job and fighting to make ends meet. In his State of the Union address on Tuesday night, President Obama outlined his plans to build on the progress made to date and ensure 2014 is a year of action, with steps to increase growth, create new jobs, and expand economic opportunity.

FIVE KEY POINTS IN TODAY’S REPORT FROM THE BUREAU OF ECONOMIC ANALYSIS

1. Real gross domestic product rose at a solid 3.2 percent annual rate in the fourth quarter, the 11th consecutive quarter of growth. Looking at the various components of GDP, growth in consumer spending picked up from the previous quarter, as did exports, business investment was in line with its recent performance, but Federal spending fell sharply, and housing posted its first quarterly decline since 2010. In the last two quarters economic growth accelerated to a 3.7 percent annual rate and over the four quarters of 2013, real GDP grew 2.7 percent, up from 2.0 percent in 2012. (Note that economists generally prefer to measure growth on a Q4/Q4 basis because that reflects what happened to the economy just in 2013, the alternative annual measure of growth also places considerable weight on what happened to the economy in 2012 and thus does not provide as meaningful a measure.)

In the last two quarters economic growth accelerated to a 3.7 percent annual rate and over the four quarters of 2013, real GDP grew 2.7 percent, up from 2.0 percent in 2012. (Note that economists generally prefer to measure growth on a Q4/Q4 basis because that reflects what happened to the economy just in 2013, the alternative annual measure of growth also places considerable weight on what happened to the economy in 2012 and thus does not provide as meaningful a measure.)

2. The private components of GDP (GDP excluding government) grew 3.9 percent over the four quarters of 2013, the strongest year of growth since 2003. This strength in the private sector came despite a multi-year trend of declining government spending, which was further compounded this past year by sequestration, as well as the shutdown in October. Indeed, real government spending declined 2.3 percent over the four quarters of 2013, the fourth consecutive year of declines. However, the bipartisan budget deal reached in December and finalized earlier this month should help ensure a more neutral fiscal stance going forward.

3. Real personal consumption expenditures, the largest component of GDP, grew 2.3 percent over the four quarters of 2013, similar to the 2.0 percent pace in both 2011 and 2012. Spending on durable goods grew 6.4 percent over the course of 2013, continuing its trend of strong growth and helped by a 660, 000-unit increase in light vehicle sales. Spending on nondurable goods grew at a more modest 2.9 percent rate, and spending on services was the slowest-growing component of consumption for the second straight year. However, in the fourth quarter alone, overall consumer spending grew 3.3 percent at an annual rate, the strongest quarterly growth in three years.

Spending on nondurable goods grew at a more modest 2.9 percent rate, and spending on services was the slowest-growing component of consumption for the second straight year. However, in the fourth quarter alone, overall consumer spending grew 3.3 percent at an annual rate, the strongest quarterly growth in three years.

4. The Bureau of Economic Analysis reported that the shutdown directly reduced real GDP growth in the fourth quarter by 0.3 percentage point at an annual rate; in addition, it may have had further indirect negative effects on growth. Because Federal workers ultimately received back pay, nominal Federal spending on labor services was in line with its average over the preceding four quarters. However, real Federal spending, which is based on hours that Federal employees actually work, fell markedly. This is one reason why the price index for Federal spending rose at an unusually high 5.4 percent annual rate.

Federal government spending as a whole subtracted a full percentage point from the annual rate of GDP growth in the fourth quarter, also reflecting a sharp decline in intermediate goods and services purchased. While the Bureau of Economic Analysis could not separately identify the impact of the shutdown on Federal purchases of intermediate goods and services, it is likely that at least some of this decline was attributable to the shutdown. In addition, the shutdown may also have reduced private economic activity due to the interruption of government services and the increase in uncertainty.

Federal government spending as a whole subtracted a full percentage point from the annual rate of GDP growth in the fourth quarter, also reflecting a sharp decline in intermediate goods and services purchased. While the Bureau of Economic Analysis could not separately identify the impact of the shutdown on Federal purchases of intermediate goods and services, it is likely that at least some of this decline was attributable to the shutdown. In addition, the shutdown may also have reduced private economic activity due to the interruption of government services and the increase in uncertainty.

5. Real State and local government spending has now edged up for three consecutive quarters, the first time this has happened since 2009, but State and local government spending still remains one of the weakest components of GDP in the recovery. On average during the four previous business cycles, real state and local government spending has risen more than 9 percent over the first four-and-a-half years of the recovery. In the current recovery, real State and local government spending has fallen 7 percent since the business-cycle trough in 2009:Q2, reflecting cutbacks that have translated into hundreds of thousands of lost jobs.

As the Administration stresses every quarter, GDP figures can be volatile and are subject to substantial revision. Therefore, it is important not to read too much into any one single report and it is informative to consider each report in the context of other data that are becoming available.

Share this Post

Related posts

Top 10 GDP 2013

They are the global economic heavyweights this year, estimated to be having the current biggest economies in the world. Here…

Read MoreCombined GDP of Africa

In June, African leaders signed a 26-nation pact — the Tripartite Free Trade Agreement (TFTA) — to create a common market…

Read More